Note: This interview was originally published on Audible.com.

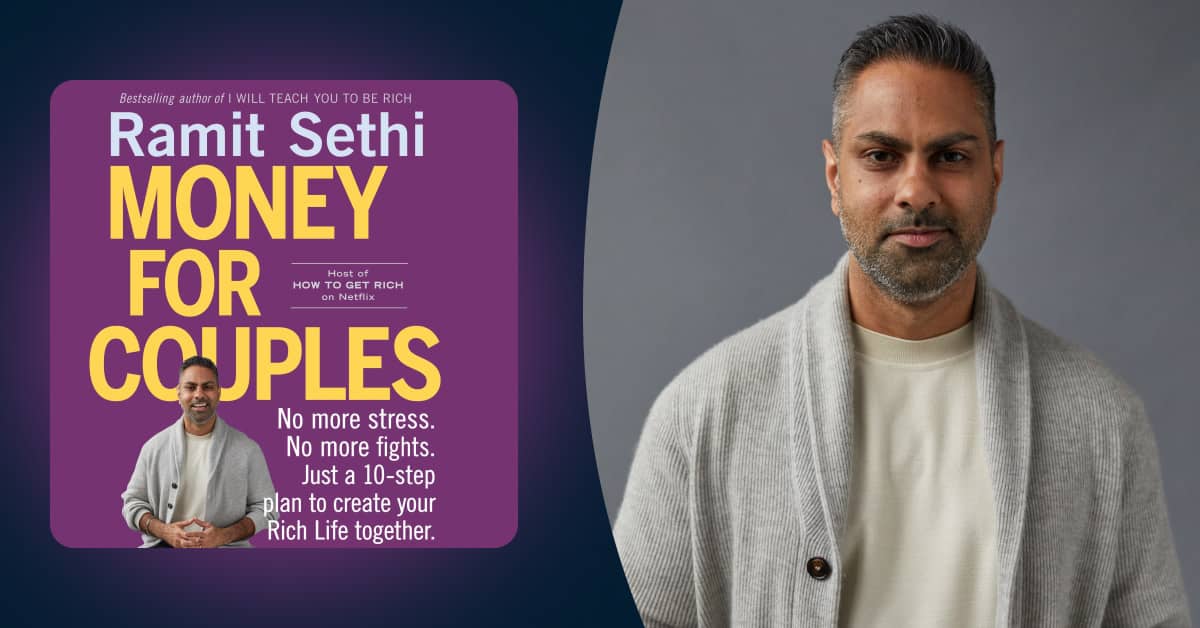

While personal finance may be on the top of everyone’s minds, it’s often a touchy subject in relationships. Thankfully, in Money for Couples, Ramit Sethi (bestselling author of I Will Teach You to Be Rich) is back to focus on helping couples amicably work toward a mutual goal that he calls a “Rich Life Vision.” Here, I asked Sethi to elaborate on why financial conversations are so critical to couples and to share some tips for how to start talking to your partner about your financial vision today.

Rachael Xerri: You have a different definition of success than most traditional personal finance experts. What does the word "rich" mean to you?

Ramit Sethi: Rich can mean traveling three months a year. It can mean buying a beautiful cashmere coat. Or it can mean picking your kids up from school every day. You decide what a Rich Life is, and it’s uniquely yours.

For me, rich means working with people I respect and like. It means traveling with my wife and loved ones. It also means spending time and money on my health. The beautiful thing about building a Rich Life—especially as a couple—is that you get to design it together, almost like a painting made personally for you.

Why do couples struggle so much with conversations about money?

Many of us were taught to avoid money. It’s common to hear things like, "Fine, just use this account to pay that bill" or "How could you spend that much?" But the truth is, you can’t get good at something unless you find a way to enjoy it, and money is something you should get good at because it affects where you live, what you eat, how you raise your family, and your relationship every single day.

If we dig deeper, most of us were never taught how to talk about money. In fact, our parents often said things like, "We can’t afford that" or "We don’t talk about money in this family." But you’d never say, "We don’t ride bikes in this family," if you expected your kids to learn how to ride a bike joyfully. That’s why we need to start talking about money in a way that’s approachable and enjoyable. We need to do it together so it’s not just one partner leading the other.

How can Money for Couples help partners overcome sticking points in their relationship?

The book Money for Couples provides specific, word-for-word scripts for having your first money conversation, discussing where to spend your money, or handling disagreements. It walks you through setting up your accounts so you’re naturally working together—not fighting over money—and spending in alignment with a shared Rich Life vision. Most importantly, the book shows you how to use money to build connection, even if you and your partner see money differently.

Do you have any tips for couples who want to start living their Rich Life today?

One of my favorite exercises is the 10-year bucket list. Sit down with your partner, grab two pieces of paper, and ask: What would you want to do in the next 10 years to live an incredibly meaningful, rich life?

Take five minutes to jot down some ideas—some personal, some joint. Then, compare notes. Get excited about what your partner writes, and have them get curious about your answers. Finally, pick one goal and make it happen. In the book, I show you how to select at least one joint bucket list goal and put money behind it. For example, six years from now, you’ll know you’re taking that dream trip to Italy. This exercise helps you build a vision where money becomes an exciting way to connect—and Money for Couples will guide you every step of the way.